Table of Contents

Introduction to Kovocredit

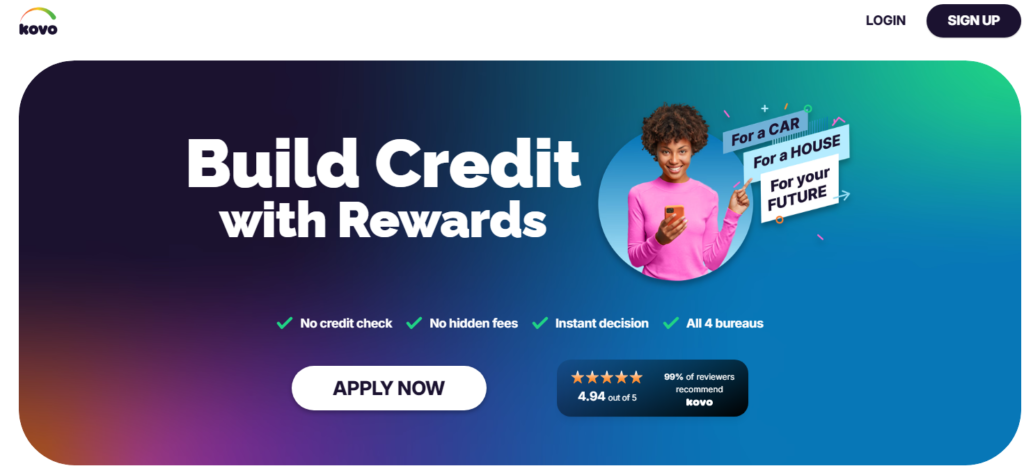

Many people today are looking for reliable credit sources that can provide flexible, quick and accessible credit in a matter of minutes. Kovocredits’ primary goals are conquering the fears of potential customers on the financial services as well as simple and easy processes of servicing which include even the provision of loans which mainly involves short ladies outfits and other types depending on the respective need. The simple way of borrowing money in Kovocredit has brought a lot of users who seek for financial help with little help to non aspects like application forms of the traditional banks.

What is Kovocredit?

It is a web based loaning service offered by Kovocredit with the aim of making the process of acquiring any funding unit as easy as possible. The company offers personal loans to its clients and usually does so in a very short period of approval. Be it a medical bill, tuition fees, or just personal endeavors, Kovocredit has solutions that are expertly customized for different scenarios.

Key Features of Kovocredit

One of the advantages which Kovocredit has is:

- Fast Application Process: Most applications are processed within the same day, if not, a few hours, thus saving time for the borrowers.

- Flexible Loan Options: Users have the options of different loan types which allows them to select on what they need mostly.

- Clear Pricing Policy: There are availed interest rates and charges without any other “secret” costs.

- Physical and Online Availability: The entire cycle, beginning from request up to credit repayment, can be managed purely online.

How Does Kovocredit Work?

Kovocredit is quite easy to use. In the first instance, the applicant is required to complete the online application form by providing the necessary personal and financial information. Supplied with the completed form, the Kovocredit’s team assesses the loan request and approves it within 24 hours. Following this, the amount in question is disbursed on the user’s account. Payments can be arranged depending on the repayment capacity.

Eligibility Requirements for Kovocredit

It is very important to know what the eligibility criteria are for Kovocredit before making any application. Kovocredit’s goal is to make these requirements straightforward as much as possible in order to make credit easy for as many people as possible. On this page are the core requirements that all covocredit applicants need to fulfill.

Basic Eligibility Criteria

While applying for Kovocredit loans, applicants usually do need to fulfill following criteria:

- Age Requirement: In most cases, the minimum age limit required for applicants is 18 years. This is important to ensure that any loans or debts taken, there should be an enabling legal age.

- Citizenship or Residency: Some countries do not give access to Kovocredit loans for non-residents or non-citizens. Applicants may need to check whether their country of residence is within the territory of the services offered by Kovocredit.

- Steady Income Source: More often than not, a regular source of income is a prerequisite. Kovocredit may demand to see proof of employment, freelance work or other reliable sources of income as a means of guaranteeing repayment of the loan.

- Bank Account: Most of the applicants are needed to have at least one operating bank account so that the funds are deposited directly after approval and repayments are made easily.

Additional Documentation

In addition to the basic criteria, Kovocredit may also ask for the following documentation for purposes of verification:

- Government ID: Some applicants tend to always possess current government issued ID (passport, national ID, etc.) in order to authenticate their age.

- Proof of Income: Income levels may be assessed through financial documents such as paychecks, landing pages and sometimes tax documents.

- Credit History: It is true that Kovocredit has a great aim of helping many applicants irrespective of their histories. However, they may evaluate your credit history for the purpose of enhancing security for the loan.

Types Of Loans Available And Their Limits By Kovocredit

Kovocredit offers its clients a range of loans for their different financial needs. Knowing the options that are offered and their limiting amounts is important for potential borrowers. Next, we explain the main types of loan and the amounts that individuals can borrow through Kovocredit.

1. Personal Loans

Personal loans out of Kovocredit can be utilized for almost anything, which includes the following:

- Emergencies: These are sudden expenses such as medical costs or last minute repair jobs.

- Home Improvements: Repairing or upgrading ones place of residence.

- Debt Consolidation: The process of taking out a new loan to pay off multiple debts.

Loan Amounts:

- In most cases, the amount loaned out fall between one thousand dollars and ten thousand dollars depending on the users income and credit rating.

2. Educational Loans

To enable education seekers, Kovocredit gives the education loans for those pursuing higher education and vocational training. Such a loan can cater for the tuition fee, books and any other relevant cost.

Loan Amounts:

- Most often the amounts fall between two thousand to twenty thousand dollars, depending on the length of the course and the respective school.

3. Business Loans

Kovocredit extends business loans to assist potential entrepreneurs who wish to either start a… Notably, the types of expenses that may be covered by the business loans include:

- Startup Costs: The expenditures incurred in the development of new businesses.

- Inventory Purchase: The acquisition of stock or supplies without which business management is impossible.

- Operational Costs: The finances availed for normal running of the business during the early stages of its establishment.

Loan Amounts:

- Their amounts vary greatly from as low as $5,000 upwards to $50,000 in accordance with the business plan and the revenues expected.

Application Process for Kovocredit

The consumer borrowing process of Kovocredit is quite basic. This is a how to guide in case you find difficulties in the following methods of application.

Step 1: Go to the Official Site of Kovocredit

The first step is to visit the Kovocredit official website. Here, you will get more about the services offered by the various loans, and who is eligible for them and their terms.

Step 2: Complete the Application Form on the Website.

Out of the types of loan available, if one has met your taste, apply for it. An online form, which usually contains:

- Personal Info: Full name, physical address, telephone centre and gender respectively plus date of birth.

- Other Info: Present occupation, earnings, and existing credits.

- Loan Info: Quantity requested and how the loan will be utilized.

Step 3: Application Support Documents Submission

There are situations that require additional paperwork, after the completion of the current form. This may include North American documents such as;

- A legal document bearing your photograph, or state’s Id, in order to corroborate your identity.

- Employment documents to indicate your employment history, for example, pay slips and bank statements.

- Other relevant documentation that will help your case.

Step 4: Review Your Application and Submit It

Ensure that everything is correct before you hit the submit button. When everything is alright according to you, you can submit your application.

Step 5: Wait Until They Give You An Answer

Once your application has been forwarded – Kovocredit will assess your application, this usually does not take more than a couple of hours. The status of your application may be communicated via email or texts.

Step 6: Money is disbursed

If the loan you applied for is granted, a loan agreement containing the necessary terms will be sent to you. It is worthwhile to take care of this one. If you agree, such funds will be credited to the bank account you have indicated very fast, within a same day or lending day. https://kovo-credit.sjv.io/19eQzB

Kovocredit: Approval Rates and Disbursement Speed

Knowing the approval time and disbursement speed of loans through Kovocredit is important for borrowers who wish to obtain the funds within a short period of time. Here’s what you can expect from the process:

Approval Time

- Application Review: After submitting your application, Kovocredit normally undertakes its assessment within a few hours. This is the stage where they scrutinize the personal and financial details as well as documentation submitted by a borrower.

- Credit Evaluation: As regards your financial history, the evaluation process may take longer should worse comes to worst with other verification. Main goal, however, is for Kovocredit to quicken this step in response.

- Notification: Upon completion of all necessary phases, you will be sent a message regarding your application. If it is a positive reply, then you shall receive a loan agreement alongside the other particulars.

Disbursement Speed

- Fund Transfer: After the loan agreement is accepted, Kovocredit takes no time in processing the fund transfer. This is to say that most borrowers receive the funds on their accounts the same day or the next business day – depending on the operations of their banks.

- Direct Deposit: Usually, these funds are deposited into your bank and hence available in cash after completion of the deposit process.

- Variations: It is important to note that however fast Kovocredit aims to disburse the funds, other variables such as public holidays or weekends could cause a minor delay in receipt of funds.

FAQs: Approval Time & Disbursement

1. How quickly can I expect approval?

Most applications take a few hours to review. However, this procedure can take longer due to additional checks.

pplication status through various means of communication provided by the company.

Customer Support and Assistance at Kovocredit

Customer support is an essential component in improving the experience of borrowers at Kovocredit. It is the aim of the platform to guide users in every stage of the loan and thus provide them with all the necessary tools to make informed financial decisions.

Support Channels

- Online Chat: Kovocredit provides an online chat functionality on its site. This enables customers with a lot of questions to easily schedule an appointment with an attendant within the business hours and hence quick assistance in case of emergencies.

- Email Support: For any queries that are more elaborate or complex in nature that may span over several issues requiring documents, customers can opt for email. Such a channel works well where there is a need for clarification on specific issues or when there is need to present useful evidence in relation to the inquiries.

- Phone Support: For existing users who wish to speak to an agent instead, a customer service hotline has been specially set up. This can be useful in situations where such issues are very complicated or when someone needs to talk to a support agent one on one.

- FAQs and Resources: There is also a useful FAQ on the Kovocredit website which addresses a number of issues and questions that users may have. This is a self-service option that can be useful to clients who do not want to reach out to support but need some information fast.

Assistance During the Application Process

- Guidance on Eligibility: In this regard, customer service representatives can offer assistance to prospective borrowers when it comes to the understanding of the factors that determine the eligibility of an applicant, and the acquisition of the relevant documents.

- Loan Options: The support staff are oriented on the different forms and sum limitations on loans and are available to assist customers in picking a suitable solution to their money problems.

- Application Status: Customers can check their application status with the help of several communication channels outlined by the company.

User Evaluations and Contentment of Kovocredit Users

User evaluations and their overall contentment serve as fundamental determinants as far as the particular lending platform is concerned. For purposes of this study, customer views express the aspirations of the borrowers and reviews the services rendered at Kovocredit.

Summary of User Experiences

- Praise: This aspect is mainly the feedback from the users concerning the application, which they describe as simple and quick getting approved and even having the money disbursed. Customers love the simple design of the website, which makes it possible to apply for a loan with much ease even for those who are not computer literate.

- Support: There are various reviews from the customers praising that Kovocredit support team is quite active and cooperative. Most of the users praise the support that they received whenever they had inquiries related to the ongoing application or clarifications on some loan aspects.

- Diverse Loans: Most of the users tend to appreciate the range of loan products offered. This is because the individuals are able to choose looking for loans that are suitable for case scenario regardless of if a short loan, long loan without assistance.

Suggestions from the Users Despite Many Reviews Have Been Positive

Even though most of the feedback is rather optimistic, a number of users admit that there are certain improvements that can be done:

- Clarity Where There Are Policies on Credit Fees: In a few instances, some consumers felt that while broadly the fees were understandable, they would prefer more clarity on some issues like late fee changes or changes in interest.

- Lengthy Processing Times for Some Applications: Some users attributed the delays in processing their applications to the provision of extra documents. This is usually the case for calls of this nature to avoid fraud however customers would be keen on knowing why exactly such issues cause delays.

User Reviews and Satisfaction At Kovocredit

Assessing user reviews is one of the elements of evaluating the quality and credibility of any service including Kovcredit. They shed some light on the experience that people received, which helps the potential customers of the service make up their minds. This is the summary of the users feedback and satisfaction.

Positive Experiences

- Hassle-Free And Quick Processing Of Applications: A lot of applicants express their satisfaction on Kovocredit because of the short and straightforward procedures for filling the forms. Clients find it convenient that they can apply without filling a lot of forms.

- Fast Processing Of Loans After Application: The numerous reviews emphasized on how borrowers almost instantly get their loan requests approved with many even receiving the money hours after applying. This is especially useful for people with financial emergencies that need to be attended to quickly.

- Various Types Of Loans Available. Users frequently express their contentment with the availability of diverse loan products. This makes many clients happy for they are allowed to select the amount of loan that fits them and the payment period.

- Help is a Phone Call Away. Customers have responded to the review by indicating that the customer support desk at Kovocredit is competent and willing to assist. Many users provided feedback after such inquiries, indicating that they found the process easy and straightforward while able to get help when needed.

Conclusion

Overall, Kovocredit is a viable alternative for those borrowers who want to get loans that are more flexible in nature and easily accessible. With their simple application procedures, fast approval periods and efficient customer care services, most borrowers often express satisfaction. There are some improvements that need to be addressed for example openness about the charges and documents required but the level of contentment of the users indicates that Kovocredit is one of the best options for people looking for a loan. As always, potential borrowers should exercise discretion and go through feedback from users to make the most suitable choice according to their circumstances. https://imamureview.com/2024/10/08/gum-toothbrush-soft-unleash-superior/